Global Sustain

Member: Platinum

Since: 26.02.2006

Since: 26.02.2006

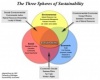

People | Planet | Profit

10 John Street, WC1N 2EB London, United Kingdom

'Innovation and growth through corporate social responsibility and sustainability'

20.01.2014

Share

By Michael Spanos, Managing Partner of Global Sustain,

Globalisation has changed the way universal problems affect economies and systems of smaller and local scales in an unprecedented speed. Moreover, the inability of our policies and systems to cater for future generations has led to global challenges such as climate change, poverty, water shortage, economic collapse, sovereign debts, species extinction and limited access to food and medicine. Governments and the corporate world have started embedding corporate social responsibility and sustainability in their DNA, as an integral part of their operations, trying to provide solutions to these problems.

And it appears that in face of shifting economies and global needs, corporate social responsibility and sustainability can appear as key drivers for innovation and growth.

Corporate Social Responsibility (CSR) has been defined by the European Commission as "the responsibility of enterprises for their impacts on society". According to the Commission, to fully meet their social responsibility, enterprises "should have in place a process to integrate social, environmental, ethical human rights and consumer concerns into their business operations and core strategy in close collaboration with their stakeholders." Sustainable development or sustainability has been defined by the Brundtland Commission -- formally known as the United Nations World Commission on Environment and Development -- as "the development that meets the needs of the present without compromising the ability of future generations to meet their own needs."

There are many times that these two terms "CSR" and "Sustainability" are used interchangeably, however, there is a growing number of stakeholders who consider "Sustainability" to be a more serious and challenging issue to engage and deal with, whereas "CSR" can many times become the communication and dialogue arm for "Sustainability".

Whatever the case, corporations and organisations discover great benefits when incorporating CSR and sustainability practices into their management approaches and business affairs -- and, yes, there is enough empirical evidence to support this argument. Just to name a few benefits:

A great innovation for example in the investment industry through sustainability is SRI, which is turning into one of the megatrends for the years to come. Sustainable and Responsible Investment (SRI), socially responsible investing, impact investing, ethical investing, Environmental, Social and Governance (ESG) investing... the precise terminology is still in the evolving phase. SRI is a generic term covering any type of investment process that combines investors’ financial objectives with their concerns about ESG issues. The integration of ESG issues in investment decision-making has triggered asset owners across the world to channel substantial capital in responsible investing. We have witnessed a remarkable growth of ESG funds trying to make SRI the mainstream investment practice and quick surf at the websites of the world's leading Sustainable Investment Forums will convince the unconvinced.

The engagement of financial services conglomerates into the ESG arena has created a market that is rapidly growing and includes research institutes, rating agencies, index providers, data sources, market intelligence experts, SRI advisers, ethical and alternative banks, investment forums, academic initiatives, asset management firms, reporting schemes, think-tanks, institutes, newswires, educational institutions, multilateral agencies and regulatory bodies. The market is definitely growing: its value is estimated at over USD 12 trillion globally. On the other hand, companies have shown an appetite to ESG disclosure. Evidence from reporting frameworks (such as the Global Reporting Initiative, the International Integrated Reporting Council) indicates a significant increase in information disclosure used by investors. The driving force of SRI in the future will be focusing on bridging the ESG gap between senior corporate executives and asset managers. The future of SRI will be shaped by two driving forces: ESG disclosure by companies will lead to increased use of ESG strategies by investors and, incorporation of ESG investment policies by large governmental institutional investors will force asset classes to adopt an ESG profile.

Without a doubt, what has boosted the evolution of CSR and sustainability issues is globalisation. The intensifying globalisation of the world’s economies has made extroversion and international business involvement particularly relevant in terms of national and global prosperity. Modern "colonialism", through export activities, is gaining momentum as a major source of economic growth. Empirical evidence show that embracing responsible extroversion brings competitiveness in international markets, high value added products and services and ability to develop synergies. In times like these, extroverted orientation on every level is needed in order to embrace change and leverage natural, human and financial capital.

Organisations that have saturated national markets, look beyond borders and navigate through the seas of globalisation and universal citizenship, with outstanding results. Products and services enter foreign markets, investors are attracted, innovation is untapped, employment is created, collaborations are encouraged and finally economic performance and social prosperity are achieved on the whole. There is no doubt that the new generation of enterprises operates profitably and thrives beyond borders, creating shared value for all stakeholders.

"Creating shared value", another term along with "CSR" and "Sustainability" that corporations and organisations should think about...

Globalisation has changed the way universal problems affect economies and systems of smaller and local scales in an unprecedented speed. Moreover, the inability of our policies and systems to cater for future generations has led to global challenges such as climate change, poverty, water shortage, economic collapse, sovereign debts, species extinction and limited access to food and medicine. Governments and the corporate world have started embedding corporate social responsibility and sustainability in their DNA, as an integral part of their operations, trying to provide solutions to these problems.

And it appears that in face of shifting economies and global needs, corporate social responsibility and sustainability can appear as key drivers for innovation and growth.

Corporate Social Responsibility (CSR) has been defined by the European Commission as "the responsibility of enterprises for their impacts on society". According to the Commission, to fully meet their social responsibility, enterprises "should have in place a process to integrate social, environmental, ethical human rights and consumer concerns into their business operations and core strategy in close collaboration with their stakeholders." Sustainable development or sustainability has been defined by the Brundtland Commission -- formally known as the United Nations World Commission on Environment and Development -- as "the development that meets the needs of the present without compromising the ability of future generations to meet their own needs."

There are many times that these two terms "CSR" and "Sustainability" are used interchangeably, however, there is a growing number of stakeholders who consider "Sustainability" to be a more serious and challenging issue to engage and deal with, whereas "CSR" can many times become the communication and dialogue arm for "Sustainability".

Whatever the case, corporations and organisations discover great benefits when incorporating CSR and sustainability practices into their management approaches and business affairs -- and, yes, there is enough empirical evidence to support this argument. Just to name a few benefits:

- Enhanced brand image, differentiation and reputation

- Stronger financial performance and profitability

- Customer loyalty, engagement and improved sales

- Increased ability to attract and retain employees

- Reduced regulatory oversight

- Easier access to capital through responsible investing

- More efficient risk management

- Cost savings (especially in energy efficiency, operating costs and reduced employee turnover)

- Competitive advantage

- Generation of innovation

A great innovation for example in the investment industry through sustainability is SRI, which is turning into one of the megatrends for the years to come. Sustainable and Responsible Investment (SRI), socially responsible investing, impact investing, ethical investing, Environmental, Social and Governance (ESG) investing... the precise terminology is still in the evolving phase. SRI is a generic term covering any type of investment process that combines investors’ financial objectives with their concerns about ESG issues. The integration of ESG issues in investment decision-making has triggered asset owners across the world to channel substantial capital in responsible investing. We have witnessed a remarkable growth of ESG funds trying to make SRI the mainstream investment practice and quick surf at the websites of the world's leading Sustainable Investment Forums will convince the unconvinced.

The engagement of financial services conglomerates into the ESG arena has created a market that is rapidly growing and includes research institutes, rating agencies, index providers, data sources, market intelligence experts, SRI advisers, ethical and alternative banks, investment forums, academic initiatives, asset management firms, reporting schemes, think-tanks, institutes, newswires, educational institutions, multilateral agencies and regulatory bodies. The market is definitely growing: its value is estimated at over USD 12 trillion globally. On the other hand, companies have shown an appetite to ESG disclosure. Evidence from reporting frameworks (such as the Global Reporting Initiative, the International Integrated Reporting Council) indicates a significant increase in information disclosure used by investors. The driving force of SRI in the future will be focusing on bridging the ESG gap between senior corporate executives and asset managers. The future of SRI will be shaped by two driving forces: ESG disclosure by companies will lead to increased use of ESG strategies by investors and, incorporation of ESG investment policies by large governmental institutional investors will force asset classes to adopt an ESG profile.

Without a doubt, what has boosted the evolution of CSR and sustainability issues is globalisation. The intensifying globalisation of the world’s economies has made extroversion and international business involvement particularly relevant in terms of national and global prosperity. Modern "colonialism", through export activities, is gaining momentum as a major source of economic growth. Empirical evidence show that embracing responsible extroversion brings competitiveness in international markets, high value added products and services and ability to develop synergies. In times like these, extroverted orientation on every level is needed in order to embrace change and leverage natural, human and financial capital.

Organisations that have saturated national markets, look beyond borders and navigate through the seas of globalisation and universal citizenship, with outstanding results. Products and services enter foreign markets, investors are attracted, innovation is untapped, employment is created, collaborations are encouraged and finally economic performance and social prosperity are achieved on the whole. There is no doubt that the new generation of enterprises operates profitably and thrives beyond borders, creating shared value for all stakeholders.

"Creating shared value", another term along with "CSR" and "Sustainability" that corporations and organisations should think about...

Source: Sweep-net.org.

.jpg)

.jpg)

1.jpg)

.jpg)

1.jpg)

.jpg)

1.jpg)

.jpg)

.jpg)

1.jpg)

1.jpg)